|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Happy New Year from the community foundation!

Happy New Year from the community foundation!We hope your 2024 is off to a good start!

Many of you have been fund holders and fund advisors at the community foundation for years, and we are grateful. Some of you established a donor-advised fund, field-of-interest fund, scholarship fund, or unrestricted fund in 2023, and we’re so glad you did. Others of you are evaluating whether to start a fund at the community foundation in 2024. We are here to answer your questions, and we look forward to working together!

Here’s what we’re covering in this issue:

As always, please reach out anytime!

Angie Tatro, CEO

Planned giving pointers

As you’ve chatted over the years with the professionals working at your favorite nonprofits, you’ve likely heard the term “planned giving.” You may have even wondered what the term means–even if you have already structured so-called “planned gifts” to support your favorite charities!

Here are a few pointers to help break down the concept of planned giving, along with ways the community foundation can help you achieve your charitable goals.

It may help to think of “planned giving” in contrast to what’s sometimes called “current” or “annual” giving. For example, when you write a check (or, ideally, give highly-appreciated stock) to a charitable organization such as your fund at the community foundation, you’re transferring those funds right away in a relatively straightforward manner. You also may be making annual gifts to several charities, and from time to time you may also make gifts to a favorite charity’s endowment or reserve fund at the community foundation.

By contrast, a “planned gift” is more complex and forward-looking than current or annual support of your favorite charitable causes. Making structured future transfers to charity is often referred to as “planned giving” because, well, these gifts require planning. Here are examples of common “planned gifts”:

–A bequest in your will or trust allows you to name a charity, such as your fund at the community foundation, to receive a certain dollar amount, or a percentage of your estate, following your death. The team at the community foundation can work with you and your advisors to include a bequest in your estate plan using the proper bequest language.

–Beneficiary designations on life insurance policies, and especially on retirement plans, can be effective tools for making bequests. The team at the community foundation can work with you and your advisors to complete the paperwork required to properly designate your fund at the community foundation as the beneficiary of life insurance or IRA assets, including reviewing with you the many tax benefits of using retirement plans to fund your bequests.

–Setting up a charitable trust, such a charitable remainder trust, is often an effective way for you to ensure that money will flow from your estate to a charity, such as your fund at the community foundation, in a way that meets both your philanthropic intentions and your financial goals (including retaining an income stream and triggering an up-front charitable income tax deduction). A charitable gift annuity is another type of “split interest” arrangement, whereby you can retain an income stream and designate a charitable beneficiary to receive a future gift. Charitable trusts are complex, and we’re here to walk you and your advisors through the process every step of the way.

Please contact the team at the community foundation. We’d love to work with you to set up planned gifts to support your favorite causes, as well as work together to ensure that you’ll meet your charitable goals for current giving in 2024.

Providing guidance for loved ones about your charitable giving

Whatever their age or health status, most people are aware that they need to document important financial and personal information for loved ones, just in case the unexpected occurs. We’ve all heard stories about someone’s family member who passed away and left little, if any, information about where to find bank accounts, passwords, estate planning documents, life insurance policies, and other information. No one wants to leave their loved ones in the lurch with scant information, but it’s often hard to get motivated to write it all down in one place.

The start of a new year is an excellent time to get organized and provide your next of kin or key advisors with the information they’d need to take care of your affairs if something were to happen to you. The list of “must haves” includes the obvious: Will, trust, power of attorney, birth certificate and marriage license, titles to cars and boats, deeds to property, car keys, bank accounts, investments and advisor contact information, life insurance policies and contact information for the agent, funeral wishes, and, critically, passcodes and passwords to devices and accounts.

What might not be obvious, though, is that you also ought to leave your loved ones with information about your charitable giving, including details about favorite charities you’ve supported over the years and information about your donor-advised or other type of fund (or funds) at the community foundation. In many instances, one member of a family has managed a family’s or a couple’s donor-advised fund, for example, while others have not been as involved in the mechanics. Be sure to include your funds at the community foundation on your list of key information, and include the community foundation’s contact information. You might also like to include a copy of your donor-advised fund agreement outlining successor advisors, as well as login credentials to the community foundation’s online fund portal.

The team at the community foundation is happy to help you put together documentation about your donor-advised fund and charitable wishes to include with the information you provide to your loved ones so they are not completely lost as they navigate how to carry out your philanthropic wishes. Even better, we’re happy to work with you anytime to show your family members exactly how your donor-advised or other type of fund works so that they are involved and participating with you in your philanthropic pursuits during your lifetime.

Making it easy for you to share the joy of giving, and also helping ensure that family members have the information they need, are top priorities at the community foundation. We are honored to work with you to help make your philanthropy easy, effective, and rewarding for everyone involved.

Clean slate: Tips for charitable giving in 2024

A new year is such a great time to plan and reboot. Cliche as it may be to talk about resolutions this time of year, it’s tough to deny that January represents a clean slate for “to do” lists, goals, and your overall mindset.

As you think about your 2024 charitable giving goals and priorities, here are a few items to consider:

You may have more capacity to give to charity.

The IRS issued inflation adjustments for important thresholds such as the standard deduction, Social Security cost-of-living adjustments, annual exclusion gifts, Required Minimum Distributions, Qualified Charitable Distributions, and levels of income for each tax bracket. Talk with your advisors about how these adjustments might impact your charitable giving goals–or even create opportunities for you to do more to support your favorite causes in 2024.

You may soon get a charitable deduction even if you do not itemize.

Many eyes are on the Charitable Act, which, if passed, would allow even non-itemizers to deduct certain charitable gifts on their income tax returns. This legislation has generated strong public support; 77% of Americans are reportedly in favor of the proposed “universal” charitable deduction.

You’ll likely still receive requests to fund disaster relief efforts.

Disaster giving is likely to remain high on the fundraising radar, meaning you will likely continue to get requests for donations to support disaster-related causes. As always, please reach out to the community foundation to strategize about effective deployment of your charitable dollars to help people who need it most in the wake of disasters and humanitarian crises.

This is a good time to review your estate plan without being rushed.

The beginning of the year is an excellent time to be sure your estate plan is in order. Many people scramble at the end of the year to execute tax planning transactions, which is understandable, but this often leaves little time for a thoughtful, strategic evaluation of the various components that make up a comprehensive estate plan, including financial planning, retirement planning, tax planning, investments and wealth management, business succession planning, planning for disability, evaluating wills and trusts as children get older and needs change, and, of course, charitable planning.

Reach out to the team at the community foundation as you and your advisors evaluate the steps you’d like to take in 2024. We’re here to help ensure that you achieve your charitable giving goals in the most tax-savvy and impact-minded way possible so that you can continue to help the causes you care about the most.

This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.

|

|

|

Hello from the community foundation!

As you gear up for the holidays and build your year-end checklist, the community foundation is here for all of your charitable giving “to do’s.” Whether you’ve been a fund holder at the community foundation for years, or you’ve just established a fund or are considering doing so, our team can help.

In this issue, we’re focusing on three topics to help enrich your experience with charitable giving.

Beyond the donor-advised fund. Many of you have established a donor-advised fund with the community foundation or are considered doing so. Donor-advised funds are terrific vehicles and there are good reasons for their popularity. What you might not know, though, is that your donor-advised fund can serve as an important hub for all of your philanthropy and pave the way for you to expand your giving strategies into issue-specific giving, family giving, and legacy giving. Learn how the community foundation can serve as your comprehensive philanthropic partner.

Structure helps family philanthropy thrive. Families don’t always get along perfectly, which is no surprise! But there’s no need for even minor family disagreements to derail well-intentioned charitable giving that allows a family to rally around favorite causes. Remember that the community foundation can serve as a sounding board, advisor, and facilitator, whether your family organizes its giving through a donor-advised fund, private foundation, or a combination of both.

Sunset is coming. Winter days are not alone on the horizon! No doubt you are hearing more every day about the scheduled sunset of the gift and estate tax lifetime exemption. Without intervening legislation, the exemption will drop back down to 2017 levels–which means it will be cut in half. That’s huge, because many more families will find themselves potentially subject to future estate tax. Charitable giving can help, though! This is a good time to talk with the team at the community foundation about how to start planning your charitable giving to reduce the potential impact of the lower exemption in 2026.

Wishing you all the best for the holidays!

Angie Tatro, CEO

Your donor-advised fund: Think “hub,” not “autopilot”

Your donor-advised fund: Think “hub,” not “autopilot”Perhaps you established a donor-advised fund at the community foundation years ago, or you set up a donor-advised fund more recently. Or maybe you are considering establishing a donor-advised fund at the community foundation this year to help you keep your giving more organized and involve your children and grandchildren in your philanthropic priorities.

Whatever the case may be in your situation, it’s a great idea to consider a few best practices for ensuring that your donor-advised fund is making the biggest difference possible for the causes you care about. Life gets busy, the months fly by, and it’s tempting to put your donor-advised fund on autopilot. But that would be a missed opportunity.

By now, you likely know that a donor-advised fund at the community foundation offers the convenience of a one-stop-shop: You make tax-deductible contributions of cash (or, ideally, appreciated stock) to the fund, and then recommend grants to your favorite charities. Make sure you’re leveraging your donor-advised fund to execute the full range of your charitable giving each year. You’ll find it so much easier to keep track over time of where you’re giving, and how much.

As the hub of your charitable giving, the community foundation certainly makes it easy for you to use your donor-advised fund for your annual giving to charities. But that’s not all. As you work closely with the community foundation, you’re likely to discover even more ways our team can support your philanthropic activities:

–We can help you establish a designated or field-of-interest fund to complement your donor-advised fund. A designated fund allows you to support a specific charity over the long term, while a field-of-interest fund focuses your support on a particular area of community need by leveraging the community foundation’s expertise. If you are over the age of 70½ and you own one or more IRAs, your designated fund or field-of-interest fund can receive Qualified Charitable Distributions up to $100,000 per year per spouse, bypassing your taxable income.

–We can work with you and your attorney to help you establish a bequest in your estate plan to support your favorite causes beyond your lifetime. Many fund holders at the community foundation name their donor-advised funds, field-of-interest funds, designated funds, or even the community foundation itself, as beneficiaries in their wills and trusts, and especially as beneficiaries of IRAs and other qualified plans because doing so delivers significant tax benefits. What’s more, the community foundation offers opportunities for our legacy donors to get together and learn from each other as a group. If you’re not involved as a legacy donor already, please reach out and we’ll fill you in!

–We can help you and your family learn more about your favorite nonprofit organizations and the issues they are addressing so that you can become more informed and effective philanthropists in our community. The community foundation team’s unparalleled, deep knowledge of local issues and organizations is a real advantage for you and your family. When you better understand the needs of the community and how your favorite nonprofits are addressing those needs, you’ll be better equipped to structure your giving so that it makes a difference in measurable ways. You’ll enjoy your charitable giving a lot more, too.

We hope you’ll consider your donor-advised fund–and your connection with the community foundation–as the hub of your philanthropy. The team at the community foundation is here to help you make the most of your donor-advised fund and related strategies so that you’re not only putting your money to work to improve the quality of life in our community, but you’re also achieving financial and philanthropic goals for your overall charitable giving.

Structured philanthropy: A process relieves the pressure

Structured philanthropy: A process relieves the pressureHelping families create a meaningful structure for their philanthropy has long been a hallmark service of the community foundation. That structure and the resulting discipline are increasingly important as both wealth and charitable giving more frequently span multiple generations. Indeed, spontaneous and unstructured conversations around wealth and philanthropy can be a source of family discord.

By being part of the discussion–whether formally or informally, at the table or behind the scenes–the team at the community foundation can help families resolve issues and smooth out the edges around common intra-family challenges, including communication, decision-making, and charitable giving.

Here are a few of the ways the team at the community foundation can help:

–Serving as a coach to foster thoughtful, intentional, and inclusive family conversations, even if the community foundation team member is serving simply in an “ice-breaker” role.

–Offering guidance from the position of a facilitator to assure that all voices are heard, particularly as views across generations can differ.

–Helping a family structure a series of discussions that employ a phased-in or “dimmer-switch” approach, beginning with values-centered discussions to identify common ground and progressing to systematic funding and allocation conversations and decisions.

The community foundation can work with a family under a variety of circumstances. For example:

–Some families enjoy organizing their charitable giving through both a private foundation and a donor-advised fund at the community foundation. The team at the community foundation can serve as a sounding board for grant making from both vehicles and also work with a family’s tax advisors to help optimize the role and use of each vehicle.

–Many families have found that a donor-advised fund at the community foundation meets all of their charitable giving needs, and they appreciate the community foundation taking on the administrative burden associated with tax filings and administration. In some cases, a family decides to close their private foundation altogether and transfer the assets to a donor-advised fund at the community foundation.

–Some families leverage the community foundation for the full suite of its charitable giving services, often using a donor-advised fund in much the same way they’d use a private family foundation, only with increased privacy and no need to create a separate legal entity, thanks to the community foundation’s umbrella 501(c)(3) status.

By consulting with the team at the community foundation, and leaning into the structure that’s right for them, families can help their favorite community causes—and keep the peace across generations.

Three things every philanthropist must know about the gift and estate tax sunset

Three things every philanthropist must know about the gift and estate tax sunsetThe shorter days of fall and winter aren’t the only sunsets creeping up on people these days. If you’ve met with your estate planning attorney and tax advisors recently, you’re probably aware that the gift and estate tax exemption–the total amount you can leave to family and other beneficiaries during life and at death before the hefty federal gift and estate tax kicks in–is about to drop, rather precipitously.

Without legislation to prevent it, on January 1, 2026, the exemption will drop from $12,920,000 per person (that’s the 2023 exemption) to about half of that amount, depending on annual inflation increases. As the date gets closer, tax planning decisions get tougher. Make aggressive moves now to activate gifts to family members? Or hold out to see if legislation intervenes to prevent the sunset?

Understandably, some philanthropists are beginning to get concerned about what their legacy might look like when (and if) the exemption drops. Add to that uncertainty the fact that a person’s date of death is among life’s great unknowns, it’s no wonder that for the relatively few taxpayers who may be impacted by gift and estate taxes—at least for now—there’s both concern and confusion.

Here’s a quick review of the facts:

–For 2023, the estate tax exemption is $12.92 million per individual, $25.84 million per married couple, and for 2024, the exemption rises to $13.61 million and $27.22 million, respectively, adjusted for inflation, as recently announced by the IRS.

–The IRS will issue inflation adjustments for 2025, too.

–For 2026, the exemption is scheduled to fall back to 2017 levels, adjusted for inflation, which would roughly total $7 million per person.

Here are a few strategies you might consider evaluating with your tax advisors now to advance your estate plan and your philanthropy plan:

–If you are a business owner, you could explore launching a gifting program to transfer shares of your business not only to heirs, taking advantage of the higher exemption, but also to your donor-advised or other fund at the community foundation. The objective here would be to begin intentionally reducing the value of your estate, assuming that the estate tax exemption will rise, while also executing a business transition plan that meets your overall intentions regardless of the tax laws. (As with any gift of a hard-to-value asset, securing a qualified appraisal is essential, as is timing; shares can’t be gifted to a charity if a sale is effectively already in process. The IRS watches both very closely.)

–Annual exclusion gifts ($17,000 per gifting spouse per recipient in 2023, increasing to $18,000 in 2024) to family members and other individuals are an effective way to reduce the value of a taxable estate without eating into the lifetime gift and estate tax exemption. Indeed, many philanthropic individuals use the annual exclusion technique as inspiration for their charitable gifts. Gifts to charities are deductible for gift and estate tax purposes (as well as for income tax purposes) and therefore also serve to reduce the value of a taxable estate without eating into the exemption. Some philanthropists report that they like the idea of making annual exclusion gifts to each family member and then using their donor-advised fund at the community foundation to make annual exclusion-amount gifts to each of the charities they support.

–Work with your tax advisors and the team at the community foundation to run various financial scenarios to determine whether the exemption sunset will affect you and if so, to what extent. If you find yourself looking at a potentially significant taxable estate in a couple of years, consider increasing your bequests to your donor-advised or other fund at the community foundation. Amounts passing to the community foundation or other qualified charity upon your death are not subject to estate tax. This means your charitable priorities will receive 100 cents on every dollar in the taxable portion of your estate, while your family and other beneficiaries could receive 60 cents on the dollar–or even less.

As always, the team at the community foundation is here to help you navigate the opportunities and pitfalls presented by changes in the tax law. It is our pleasure to work with you and your advisors to maximize your charitable goals.

This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.

|

|

|

|

The team at the community foundation is here to help you navigate your charitable giving priorities all year round, and especially during the giving season when we know many of you are beginning to turn your attention to tax planning and ensuring that you’ll meet your charitable goals before the end of December.We are grateful for those of you who’ve already established a fund at the community foundation, and we are also grateful for those who are considering it. We’d love to work with you. The community foundation is our region’s trusted source for all things philanthropy, and we are honored to serve you as you pursue the charitable endeavors that mean the most to you and your family.

Wishing you all the best for a safe and happy Thanksgiving.

Angie Tatro, CKCF CEO

Get ahead of the year-end rush

Get ahead of the year-end rushRemember that the 2023 standard deduction for single taxpayers ($13,850) and married filing jointly ($27,700) is up nearly 7% over 2022. While this increase allows for more relief from income tax for most filers, it also sets a higher bar to exceed for those who itemize deductions. Keep your household’s standard deduction amount in mind when you tally your deductible expenditures, including your gifts to charity. Reach out to the community foundation for help.

If your total deductions are at or under the standard deduction amount for 2023, but you and your advisors determine that your particularly high income this year means you could benefit from increased deductions, a “bunching” strategy may be a good fit for you. “Bunching” means you are “front-loading” charitable donations into the current year, knowing that you plan to make these donations in future years. By structuring a large year-end gift to your donor-advised fund at the community foundation, you could surpass the standard deduction threshold to further reduce your taxes in 2023. Then, your favorite organizations can receive support from your donor-advised fund not only this year, but also in subsequent years. This allows you to provide predictable, steady support for the causes you love. Our team can help you build a strategy!

As you prepare for year-end giving, don’t automatically reach for the checkbook! Gifts of long-term appreciated stock to your donor-advised or other type of fund at the community foundation is always one of the most tax-savvy ways to support your favorite charitable causes because capital gains tax can be avoided. Similarly, if you are a business owner, you can work with your advisors and the community foundation team to explore how you might give shares in the business to your fund at the community foundation as a part of your overall estate plan. Not only will transfers be eligible for a charitable deduction during the year of transfer (and at fair market value if you held the shares for more than one year), but also these gifts could potentially reduce income tax burdens triggered upon a future sale of the business.

As always, keep in mind that the Qualified Charitable Distribution (“QCD”) is a very smart way to support charitable causes. If you are over the age of 70 ½, you can direct up to $100,000 from your IRA to certain charities, including a field-of-interest, designated, unrestricted, or scholarship fund at the community foundation. If you’re subject to the rules for Required Minimum Distributions (RMDs), QCDs count toward those RMDs. That means you avoid income tax on the funds distributed to charity. Our team can work with you and your advisors to go over the rules for QCDs and evaluate whether the QCD is a good fit for you.

Keep an eye on the Charitable Act, which, if passed, would permit a deduction for charitable gifts that exceed the standard deduction. The Charitable Act proposes to restore the pandemic-era “universal charitable deduction” and raise the cap from $300 for individuals ($600 for joint filers) to approximately $4,600 for individuals ($9,200 for joint filers). This could be a game-changing incentive for your favorite charities–and for you!

Please reach out to the community foundation team to find out when certain transactions must occur to be legally completed during this tax year, including checks to your fund at the community foundation which must be postmarked or hand-delivered no later than December 31. Gifts of marketable securities also need to be fully transferred by December 31, so please work with your advisors to contact us in plenty of time for our team to process and receive the transfer.

Gifts of “complex” assets deliver multiple benefits

Gifts of “complex” assets deliver multiple benefits

When you think about supporting your favorite charities or making contributions to your donor-advised or other type of fund at the community foundation, cash may be the first thing that comes to mind. It seems so easy to just write a check or donate online. (You probably don’t immediately think of artwork or other types of assets!)

Most of the time, gifts of highly-appreciated marketable securities are the most logical non-cash gift. Gifts of publicly-traded stock, for example, are easy to transfer to your donor-advised or other type of fund at the community foundation. The community foundation team can provide you or your advisor with transfer instructions to make the process simple. As is the case with a cash gift, the community foundation will provide a receipt for tax purposes, and your gift of stock will be valued at the shares’ fair market value on the date of transfer. When the community foundation sells the shares, the proceeds flow into your fund without any reduction for capital gains taxes. This is because the community foundation is a 501(c)(3) charitable organization and therefore does not pay income tax. That would not have been the case, however, if you had sold the stock first and then transferred the proceeds to your fund at the community foundation; you’d owe capital gains tax on the sale. Especially in cases where you’ve held the stock a long time and it’s gone up significantly in value since you bought it, the capital gains hit can be significant.

Cash and publicly-traded stock are not your only options for adding to your fund at the community foundation. You can also give assets such as real estate, closely-held business interests, and even artwork or other collectibles. When you give assets like this to a fund at the community foundation or other public charity, the tax treatment of these “alternative” assets is the same as gifts of marketable securities in that no capital gains tax will be levied when the charity sells the assets, and, assuming the assets are “long term” capital gains property under IRS rules, you’ll be eligible for a charitable deduction at the fair market value of the assets on the date of transfer. Gifts of assets other than cash or marketable securities are sometimes called gifts of “complex assets,” but that does not mean the process needs to be intimidating. The team at the community foundation can work with you and your advisors every step of the way.

You can also use “complex” giving techniques to achieve your estate planning and tax goals. For example, if you are over 70 ½, the community foundation can work with you and your advisors to execute a Qualified Charitable Distribution from your IRA to a designated or field-of-interest fund. Or, we can work with you and your advisors to establish a charitable remainder trust if you’d like to retain an income stream and also get the benefit of an up-front charitable deduction.

As the end of the year approaches, it’s a good time to evaluate your portfolio with your advisors to determine whether a gift of complex assets might help you support a critical need in the community while providing key tax benefits for you and your family.

If you have questions about an asset you’re interested in contributing, please reach out to us. The community foundation is happy to help you establish a charitable giving plan and take the complexity out of giving complex assets.

Whether you’re motivated to respond to needs created by a conflict, accident, or natural disaster, it’s human nature to want to help—especially through financial support. All too often, a tragic event occurs and is quickly publicized through news accounts or social media. Then, the dollars start rolling into a crowdfunding site like GoFundMe, Kickstarter, or Fundly.

And therein lies a problem. Or a potential one, at least.

Well-intended zeal and urgency to give may not be truly aligned with the needs. Unfortunately, not all “dollar destinations” are legitimate, either in their authenticity or their declarations that a specified gift percentage will be delivered as intended. Among fraudsters’ tools are TV ads that can pop up overnight; illicit websites or URLs bearing seemingly familiar names (known as phishing); or digital money transfer recipient addresses or account names that are difficult if not impossible to verify. In some cases, donors are mistaken or confused about the deductibility of their contributions. Even the IRS is issuing warnings about crisis giving and potential fraud.

Count on the community foundation as your trusted source to authenticate grantee organizations. Our team not only knows the charitable landscape, but also we can fully vet recipient organizations for qualification and tax deductibility. The community foundation’s role is especially important and relevant in light of a recent study that revealed a growing decline in trust in nonprofits–despite nonprofit organizations still being among the most trusted organizations (along with small businesses).

The community foundation is here to help you navigate all of the considerations that factor into making a tax-deductible gift to a legitimate organization that can truly help offer the relief you intend. Indeed, mobile devices have made it easy to act on our honest instincts. However, in an increasingly impatient, noisy, and short-attention-span world that can carry a “get ‘er done” urgency, haste often makes waste.

Please give us a call to talk through your options for crisis giving and how to make sure your dollars get to the people and places that need it most.

This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.

I am so excited to be the newest employee at CKCF, and the more I am learning about the job and the foundation, the more I feel like I have landed in the right place.

I am so excited to be the newest employee at CKCF, and the more I am learning about the job and the foundation, the more I feel like I have landed in the right place.

I was born and raised right here in Newton, Kansas, and after moving about the country for 10 years going to college, and managing Photography Studios, I decided to raise my own family here in Newton.

I have spent much of the last decade working in the Dental field and as much as I like teeth, I am looking forward to this new avenue of learning and growth with CKCF, doing work that makes me proud and feel good.

My wonderful husband (Derrick) and I, have FIVE beautiful children, Emerson (15y), Gray (12y), Lennon (10y), Cole (6y) and baby Isla (10 months). When we aren’t busy with all the sporting and school activities, we enjoy camping, music, vacationing, cooking, and just spending time as a family.

I can’t wait to meet you all and get to know everyone better!

Hello from the community foundation!

Hello from the community foundation!

We hope this note finds you well. In our community and across the country, families are gearing up for a busy fourth quarter. Giving season shifts into full gear, and we look forward to working with you! Whether you’ve already established your donor-advised or other type of fund at the community foundation or are currently considering it, please reach out. We would love to help you get even more connected to the causes you care about while maximizing tax benefits at the same time.

In this issue, we’re covering topics that are on the minds of many people as the year winds down.

Retirement and charitable giving continue to be intertwined. Over the last few years, we’ve all seen retirees who’ve gone back to work, colleagues who decided to retire early, and everything in between. Because IRAs and other retirement accounts are such useful assets for charitable giving, it is important to recognize the opportunities presented for charitable giving at every stage of retirement, from contemplating retirement all the way through to permanent retirement. Learn how the community foundation has you covered!

Meeting your 2023 charitable goals does not have to be stressful. The end of the year is a well-documented season of anxiety for many people. Fortunately, working through the list of organizations you’d like to support can be a bright spot. The team at the community foundation can help you accomplish your charitable giving objectives efficiently, effectively, and joyfully, including tapping into tax benefits. Learn why waiting until the end of the year to complete your giving actually has a silver lining.

Do good, feel better. It is not your imagination! When you give to charity or do something good for others, you really do feel better. From reductions in risks for high blood pressure to sleeping better at night, learn why philanthropy is such a powerful catalyst for well-being–both your own well-being and the health and happiness of the people whose lives you are improving through gifts to your favorite nonprofits.

Thanks again for all you do. We are honored to work together and wish you the best.

–Angie Tatro, CKCF CEO

At the community foundation, we regularly talk with retirement-age donors and fund holders about the tax benefits of Qualified Charitable Distributions and leaving bequests of IRAs to a donor-advised fund at the community foundation. But getting involved in philanthropy can be so much more than that for retirees and people who are gearing up (or down!) for retirement. This is particularly relevant as some retirees consider returning to work and contemplate what that means for their charitable giving and volunteering plans.

At the community foundation, we regularly talk with retirement-age donors and fund holders about the tax benefits of Qualified Charitable Distributions and leaving bequests of IRAs to a donor-advised fund at the community foundation. But getting involved in philanthropy can be so much more than that for retirees and people who are gearing up (or down!) for retirement. This is particularly relevant as some retirees consider returning to work and contemplate what that means for their charitable giving and volunteering plans.

You’ve likely heard the statistic that 10,000 people in the United States are turning 65 every day. And while 65 may be the “traditional” retirement age in this country, the milestone appears to be anything but traditional nowadays. While Covid-19 did not impact retirement ages as much as some might have predicted, many of those who did retire actually now regret it. While many retirees are seeking work for financial reasons, two of the top six reasons to go back to work involve boredom or loneliness.

For people who’ve reached a theoretical retirement age, working or returning to work provides many opportunities that tie into philanthropy. For example:

–You can still contribute to your IRAs (which many people do not realize), and if there’s an employer-sponsored 401(k) plan, all the better.

–You can use your extra income to fund your donor-advised fund at the community foundation, making you eligible for an income tax deduction as well as removing assets from your taxable estate.

–As you take advantage of the opportunity to get more involved with causes you care about in your free time (which has perhaps increased because children have grown), you can update your estate plan to leave additional bequests to your donor-advised fund at the community foundation to support your favorite causes after you’re gone.

–And of course, if you are 70 ½ or older, you can take advantage of the Qualified Charitable Distribution (QCD) which allows you to direct up to $100,000 annually from your IRA to a qualified charity, and even more in future years as the $100,000 cap is indexed for inflation. Plus, if you’ve reached the age when you are required to take distributions from your IRAs, QCDs will offset those Required Minimum Distributions (RMDs).

For those who’ve retired for good, remember that many of the organizations you care about could likely use your help not only financially as a donor, but also as a volunteer, board member, or community advocate.

Please reach out to the team at the community foundation. We’d love to work with you on your charitable giving plans for retirement, un-retirement, or re-retirement, as the case may be! Your seasoned professional skills and civic commitment are truly valuable to improve the quality of life in our community.

You are not alone if you begin to feel a little anxious when October rolls around. Many people experience year-end stress, whether because of looming deadlines at work, tax-related estate planning cut-off dates, anticipating a busy holiday season of travel and social engagements, or simply the realization that another year is coming to a close and there’s not a lot of time left to check off items on the 2023 punch list.

You are not alone if you begin to feel a little anxious when October rolls around. Many people experience year-end stress, whether because of looming deadlines at work, tax-related estate planning cut-off dates, anticipating a busy holiday season of travel and social engagements, or simply the realization that another year is coming to a close and there’s not a lot of time left to check off items on the 2023 punch list.

To top it all off, many families do a lot of their charitable giving at year end, too. But that’s one area that does not need to be stressful. Your giving can be more easily accomplished than sending invitations, herding family members, guessing colors or sizes, and remembering who to include–or not!

Here are three tips for alleviating fourth-quarter stress and still be able to hit your charitable goals for 2023.

–Using your donor-advised fund at the community foundation makes giving very convenient. Through the foundation’s online portal, you can easily view a list of all of the organizations you’ve supported so far this year, make note of the ones you missed or want to add, and then finish the annual task.

–Your late-year timing could actually be useful for the organizations you care about, given the pronounced need for support during the gift-giving time of year, whether that’s to an organization seeking to achieve its own year-end goals or an organization that provides food or utility bill relief during the cold winter months. According to National Giving Month, 31% of charitable giving occurs in December; 12% of giving typically occurs between December 29 and 31; and 28% of nonprofits raise as much as 50% of their funding in December.

–Charitable needs are heightened during the fourth quarter because it is especially stressful for people experiencing financial challenges. For 52% of respondents surveyed in a 2023 study, money was the most cited factor that negatively affects their mental health, a level 25% higher than a year ago. The organizations supporting these people are in high gear during the fourth quarter and holiday season.

–By the end of the year, you will likely have a better idea of your financial situation, ideal target amount for charitable tax deductions, and the performance of stock in your portfolio. This will allow you to make gifts to your donor-advised fund of highly-appreciated stock, avoid capital gains, and reduce your taxable estate. And, of course, the proceeds of that stock will hit your donor-advised fund tax free, so the full amount of the sale price is available to support your charitable giving priorities.

Completing your 2023 charitable giving can reinforce philanthropy’s win-win value proposition: You can check a task off your list by supporting causes and organizations that are important to you and receive key tax benefits, and those in need will appreciate your generosity while feeling a greater sense of the season’s spirit.

Philanthropy means “love of humanity”—and, according to some, “philanthropy” includes acts that benefit both the giver and the receiver. This is surprising to some people who have been taught “it’s better to give than to receive.”

Philanthropy means “love of humanity”—and, according to some, “philanthropy” includes acts that benefit both the giver and the receiver. This is surprising to some people who have been taught “it’s better to give than to receive.”

Somehow we have popularized the idea that giving should “hurt.” But that is not what the research says. Consider just a few examples:

When people were asked to reflect about all the ways they do good (giving to charity, volunteering, serving on boards, donating canned goods, purchasing products that support a cause, celebrating at community events, sharing with others, and so on), 92% reported that they felt better about themselves.

Even just thinking about what you’ve given others–and not only just being grateful for what you’ve received–is a huge motivator to do good things for others, over and over again.

The “do good feel good” benefits of philanthropy is just one of the many reasons that so many individuals and families work with the community foundation. If you’ve already established a donor-advised or other type of fund with the community foundation, we look forward to continuing to help you fulfill your charitable wishes to improve the lives of others. If you’ve not yet established a fund at the community foundation, we look forward to working with you to make a difference in the causes you care about.

This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.

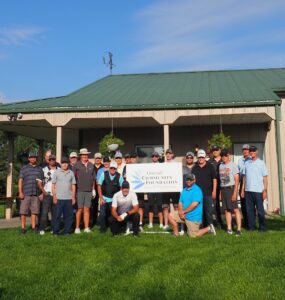

The Goessel Community Foundation Benefit Golf Tournament was held Saturday, September 16th at Pine Edge Golf Course, rural Goessel. The day was perfect for golfing. Between golfers and our generous sponsors, we raised $7,500. With the Patterson Family Foundation Match, that amount will be doubled at the end of the year.

The Goessel Community Foundation Benefit Golf Tournament was held Saturday, September 16th at Pine Edge Golf Course, rural Goessel. The day was perfect for golfing. Between golfers and our generous sponsors, we raised $7,500. With the Patterson Family Foundation Match, that amount will be doubled at the end of the year.

All golfers received a homemade food item donated by the GCF Board Members. Choices of cinnamon rolls, fruit pies, cookies, brownies, coffee cake, homemade bread, cupcakes, etc. were awarded as “prizes” to golfers. This tournament is unique, with all participants going home with a prize. Thank you to all the golfers who came out to Pine Edge Golf Course Saturday for their part in our annual fundraiser for the Foundation.

At our Golf Tournament, the first place team of Chet Roberts of North Newton and Leroy Koehn of Moundridge got to pick first from the table of baked good prizes. Stacey Sawyer of Goessel and Doug Mcguire from Marion placed second.

You can see more on the Goessel Community Foundation Facebook Page.

We hope the end of summer has treated you well and that you are gearing up for the busy months ahead as 2023 begins to wind down. We have heard from many of you that charitable giving is on your minds. Certainly, philanthropy is an important topic during the latter part of any year as you and other charitably-minded individuals and families plan out the support you’d like to provide to your favorite charities. This season, charitable giving is even higher on the radar because of the recent natural disasters and the desire of so many to do whatever they can to support relief efforts.

We hope the end of summer has treated you well and that you are gearing up for the busy months ahead as 2023 begins to wind down. We have heard from many of you that charitable giving is on your minds. Certainly, philanthropy is an important topic during the latter part of any year as you and other charitably-minded individuals and families plan out the support you’d like to provide to your favorite charities. This season, charitable giving is even higher on the radar because of the recent natural disasters and the desire of so many to do whatever they can to support relief efforts.

We are grateful to have the opportunity to work with so many of you who are already donors and fund holders at the community foundation. For those of you who are considering establishing a donor-advised or other type of fund with the community foundation, thank you! We appreciate your consideration and look forward to meeting with you soon to put together a charitable giving plan that meets both your philanthropic goals and your goals for your financial and estate plan.

In this issue, we are covering four topics that are bubbling up in many conversations:

–Helping those affected by the Maui fires and Hurricane Idalia is a top priority for many of you. Our community foundation, as well as many community foundations across the country, are rallying support for people in need in the wake of these and other disasters. Please reach out. We can help ensure that your generous gifts are deployed in the most efficient and effective way.

–Several of you have reached out to ask about the Roth treatment of 401(k) “catch up” contributions for some workers over 50 that has appeared to be a moving target! What does this even mean for charitable giving–and for you? The net-net is that those of you who would have taken a tax hit now are getting a two-year reprieve, which could leave you with potentially hundreds of extra dollars, which you can now give to charity if you are so inclined.

–Always popular in discussions about charitable giving, retirement plans continue to be at the forefront of many donors’ plans for bequests to their donor-advised funds at the community foundation. This is a good thing; donors who leave IRAs to their kids, for example, and leave their stock to charities are missing out big time on tax benefits. Call the team at the community foundation to learn how you can be even more savvy about the way you provide for both charities and your children in your estate plan, especially now that the “stretch IRA” is no longer.

–This is the time of year when we start to get a lot of questions from donors about food insecurity, and especially about how to involve children in the charitable giving conversation. The community foundation is happy to provide tips and insights about why food insecurity is such a big deal and how even the youngest donors can get their heads around the magnitude of the issues.

As always, we look forward to hearing from you! Thank you for everything you do for the community we all love.

Wishing you all the best,

Angie Tatro, CKCF CEO

Our hearts go out to the people of Maui—and all of Hawaii—in light of the tragic fires that occurred early in the month. By all accounts, those will take years, if not decades, to recover and rebuild from. Restoration costs are already estimated at $5.5 billion, although only time will tell just how much time and money will be needed.

Our hearts go out to the people of Maui—and all of Hawaii—in light of the tragic fires that occurred early in the month. By all accounts, those will take years, if not decades, to recover and rebuild from. Restoration costs are already estimated at $5.5 billion, although only time will tell just how much time and money will be needed.

As if that weren’t enough, much of the U.S. slogged through what has been called the hottest summer ever—and July as the hottest month ever—with uncomfortably high temperatures affecting land and sea even before the start of hurricane season. And then there was Tropical Storm Hilary and a simultaneous magnitude 5.1 earthquake that struck Southern California. To round out the month, Hurricane Idalia made landfall on August 30, with extensive damage reported and tens of billions of dollars of losses projected.

Fortunately, community foundations are well-suited to facilitate and manage relief funds for disasters and humanitarian tragedies, no matter where they occur. Certainly local community foundations in the areas most affected by a disaster consistently jump in immediately to establish funds to accept donations, which the community foundation then deploys rapidly and effectively to high-performing nonprofit organizations that are delivering relief where it is needed most urgently.

Even community foundations and other charitable foundations that lie outside of affected geographic areas are committed to responding quickly by launching their own fundraising efforts, either promoting the funds established by community foundations in the affected areas or their own funds created to directly support relief efforts. Indeed, disaster relief funding is frequently coordinated by community foundations, which are widely viewed as one of the very best vehicles to help donors provide financial support to relief efforts. Community foundations understand, for example, that the most immediate needs in the wake of a disaster are often for food, shelter, water, and hygiene kits. In addition, the community foundation knows which nonprofit organizations on the ground are best qualified to meet those needs.

With a deep understanding of philanthropy and charitable giving tools to effect meaningful change, the team at the community foundation is here for you. Whether your interests include disaster relief, education, the arts, social services, or other causes near and dear to your heart, the community foundation can help you fulfill your goals and intentions.

Legislation known as SECURE 2.0 contained a dizzying array of changes to the laws governing retirement plans. Passed at the end of 2022, SECURE 2.0 is 130 pages long; overall, its purpose is to encourage more retirement savings through vehicles like employer-sponsored 401(k) plans.

Legislation known as SECURE 2.0 contained a dizzying array of changes to the laws governing retirement plans. Passed at the end of 2022, SECURE 2.0 is 130 pages long; overall, its purpose is to encourage more retirement savings through vehicles like employer-sponsored 401(k) plans.

Lately, the buzz around SECURE 2.0 has been focused on a very specific provision addressing what are known as 401(k) “catch up” contributions. A “catch up” contribution allows a worker aged 50 and older to pump more money (an extra $7500 in 2023) into their 401(k) plans, beyond the usual $22,500 statutory maximum for employee deferrals.

Normally, an employee’s contributions to a 401(k) are not included in adjusted gross income for tax purposes, which is a big perk. But under the provisions of SECURE 2.0, if you are at least 50 years old and earned $145,000 or more in the previous year, these catch-up contributions would be treated like Roth IRA contributions–meaning the money used to make those contributions is after tax. Essentially, you will be paying tax on the money you use to make the catch up contributions. Depending on your tax bracket, the extra tax could possibly tally into the thousands of dollars.

But! The IRS’s recent ruling has delayed the Roth treatment provision, so that it will not become effective until 2026. This means your catch-up contributions are still “pre-tax,” at least for the next couple of years.

What is the bottom line here? If this situation applies to you–if you are over 50, earn more than $145,000 a year, and want to make catch-up contributions to your employer-sponsored 401(k) plan–you now have an extra couple of years to enjoy the tax perks of these contributions. This relief, in turn, might allow you to make larger charitable gifts than you had originally planned when you budgeted for 2023’s charitable giving.

As you build your estate plan and consider how to provide for your adult children, keep in mind that naming children as the beneficiary of an IRA or other qualified plan probably is not something that should be automatic.

As you build your estate plan and consider how to provide for your adult children, keep in mind that naming children as the beneficiary of an IRA or other qualified plan probably is not something that should be automatic.

For starters, if you are charitably-minded and have other assets, such as highly-appreciated stock, to leave your children, those assets should come first. This is because your children will inherit the stock at a “stepped up” basis, meaning their capital gains tax hit upon sale will be far less. Plus, if you name a charitable organization, such as your donor-advised fund at the community foundation, as the beneficiary of your IRA, the IRA proceeds won’t be depleted by either income tax or estate tax. Your kids, on the other hand, will have to pay income tax on the proceeds of an inherited IRA.

This dynamic became even more important to consider when the law changed a few years ago, such that a child who was named as the beneficiary of a parent’s IRA, for example, could no longer count on a relatively straightforward and tax-savvy method of withdrawals called the “stretch IRA.” With the passage of the SECURE Act, that changed for many children who inherited an IRA after December 31, 2019. Instead of taking distributions over their lifetimes, affected children now need to withdraw the entire inherited IRA account within a 10-year period as calculated under the law.

If you’re evaluating options for how to handle an IRA in your estate plan, talk with your advisors and the community foundation about leaving an IRA to your donor-advised fund or other charity via a beneficiary designation. Or, if you’d still like to provide an income stream to your children following your death, in some circumstances it might be worth considering establishing a charitable remainder trust to name as the IRA beneficiary (assuming the stars align vis-a-vis children’s health, their tax brackets, projected returns, and other factors).

Importantly, if you are a child of parents who own IRAs, they will appreciate you bringing this opportunity to their attention! Your parents might not realize that their good intentions to leave their IRAs to their children could be saddled with tax burdens down the road. Encourage your parents to talk with their advisors and give the community foundation a call. We are here to help make IRAs a win for everyone–your parents, their favorite charities, and you!

Though natural disasters and the resulting humanitarian needs are frequent but sporadic, the need for food in our community is an everyday constant. And with school back in session, the needs among the food insecure and food banks—often met through philanthropic generosity—are heightened.

Though natural disasters and the resulting humanitarian needs are frequent but sporadic, the need for food in our community is an everyday constant. And with school back in session, the needs among the food insecure and food banks—often met through philanthropic generosity—are heightened.

Compounding the issue is that food inflation remained relatively high at 4.9% in July, despite being less than half of its mid-2022 11.4% rate. Typically second only in household budget importance to shelter, food’s nearly 5% year-over-year increase frustratingly occurred when prices for gasoline, natural gas, and airline fares registered double-digit declines, according to July’s Consumer Price Index figures. Digging deeper into the food price conundrum, food-at-home importance was more than double of food-away-from home. Deeper still, the prices for produce and convenience foods like cereal and bakery products led the price increases.

Together, food’s high demand and prices are straining philanthropic food dollars. This reduces funding availability for other needs, especially seasonal back-to-school clothing and supplies, and also utility relief due to the scorching summer temperatures.

Many donors and fund holders at the community foundation like to stay up-to-date on what’s going on with the need for food. Indeed, many families discuss food insecurity with their children and grandchildren as an opportunity to learn about philanthropy because it is easy for even young children to understand how important food is to well-being and what it might feel like to be without it.

Here are three insights you can consider as you talk with your family about the importance of charitable giving to support families in your community who are faced with challenges putting food on the table:

By working with the community foundation, you and your family can learn about charitable organizations in our community that are striving to help people who are facing hunger. Whether you’d like to support a local organization, or perhaps an organization in the community where you were raised or have a particular interest such as the locale of a second home, the team at the community foundation can help you make a difference through your donor-advised fund, arrangements for bequests and other planned gifts such as retirement plan beneficiary designations, a field-of-interest fund, and many other charitable giving vehicles that are designed to meet your charitable goals as well as your financial and tax goals.

This newsletter is provided for informational purposes only. It is not intended as legal, accounting, or financial planning advice.